Today’s forces of disruption are having a marked effect on the way businesses approach change and transformation. Is the greater demand for growth the reason why private equity-backed businesses are getting more from commercial executive interims and leaving the larger public corporates trailing in their wake?

Whereas traditionally business change programmes were large, slow-moving and often cyclical, changes in consumer behavior, shifting regulation, new types of competitors and advancing technologies of production and distribution have created a heightened appetite to innovate faster. The result of this is multiple change and transformation programmes at both a business-wide and functional level being run at any one time.

As businesses embark on these increasingly frequent change programmes, whether strategic or tactical in nature, they often require an injection of leadership expertise to provide additional capability for their internal teams and help them plan and deliver transformation.

If internal teams are stretched or don’t have the capability to execute the change themselves, traditional recruitment processes may not be the most effective solution due to the length of time it takes to run a process to completion, the difficulty in attracting top talent (particularly if the business is in distress) notice periods adding a further delay to the proposed start date, or because that specific skill set may not be needed in the business after the programme has been completed.

In these scenarios, Management Consultancies or Executive Interim Managers (Executive Interims) are the most popular resources businesses turn to, where their high levels of experience, expertise, and speed of deployment bring a significant advantage in fast-paced change environments.

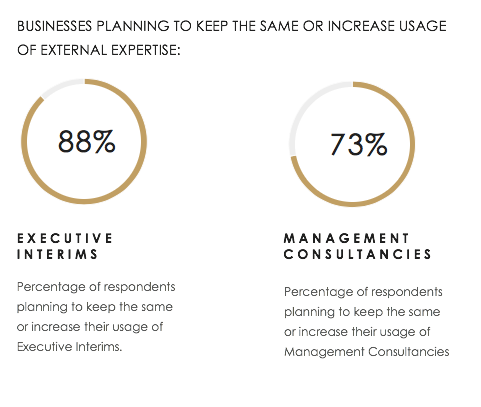

It’s expected that the demand for these types of resources will only increase. A recent research study of over 100 senior executives at large UK businesses by Savannah Group examined the role of external expertise. The study found over 50% of businesses are currently using Executive Interims and 88% expect their use to stay the same or increase in the future. Meanwhile, 73% of respondents were currently using Management Consultancies and the same amount, 73%, expected their usage to stay the same or increase.

Commercial Interim Managers Offer Businesses New Opportunities

While business change, functional change or steady state scenarios continue to be common deployment scenarios for Executive Interims, over the past five years we have seen a steady increase in the popularity of using Interims in a commercial context.

Deployment of Interims into a commercial function makes sense. Executive Interims are seasoned executives with proven experience in a multitude of blue-chip firms and a track record of driving growth within an organisation. Their ability to solve situational challenges negates the need for sector-specific experience while their years of experience within a variety of different businesses allows them to look at a business in an objective way and identify ways of driving profitability that may have been overlooked or missed.

Leadership Traits of Commercial Interim Executives

Leadership by Interims in the Commercial Function differs from permanent long-term management. There is a different mindset when an interim commercial manager goes into a post. They focus on a set of deliverables… a clearly defined set of outcomes that will deliver a positive impact.

Similarly, a lack of political agenda allows them to both be impartial in their decision making and deliver the type of message an individual in a permanent position might find it hard to deliver themselves. Their ability to be deployed at short notice for twelve to eighteen months provides high impact over a clearly defined period of time while providing space for the organisation to understand the formula that will make them as profitable as possible and recruit a longer term permanent commercial leader to succeed them.

There are three scenarios in particular where commercial Interim Executives are proving to be particularly valuable assets:

Scenario 1: Fast growth

Businesses experiencing high growth need to rapidly recruit to keep up with demand, however with their business continually evolving, it can be a tricky balance between getting the person they need for the short term while also ensuring that person has the skill set to be the right type of person for the mid to long term.

This scenario is particularly common with online businesses. For example, a fast-growing online retail business was looking to continue their growth trajectory while scaling their business and needed a Chief Marketing Officer with a background in digital marketing and retail e-commerce. Aware that this market was very competitive they decided to engage an Interim CMO to give them flexibility on both what they could pay and attract as well as giving them quick access to the skills they urgently needed. The new interim CMO was brought on board with a key focus of leading the team through peak trading and to deliver a market strategy for the next two years.

In his time with the business, the interim CMO was able to deliver significant short-term uplifts by optimising the businesses during peak trading and develop a long-term strategic roadmap.

It’s not just delivery on the assignment that Interims can offer. As the business continued to grow at a fast pace, the Interim CMO worked with the CEO to help recruit a long-term permanent replacement. After the replacement CMO was found and boarded into the organisation, the business was so impressed by the interim CMO they continued to engage him as a consultant on a part-time basis.

Scenario 2: Transforming the operating model

Particularly common in VC or private equity backed businesses, there are times when businesses spot a lucrative opportunity to either radically redesign or expand its product or service offering or target a new customer base. In those scenarios, a commercial Interim Executive can use their experience to transform the operating model while acting as a bridge between the executive team and the investment team.

Consider the example of a recently acquired global technology business who were operating mainly in the B2C market. The private equity firm that bought them wanted to execute a business growth strategy focused on growing their B2B proposition and product offering. To deliver this, the business recruited an interim Commercial Programme Director to drive the development and expansion of the enhanced Proposition to ensure that the business met Executive and Investor expectations without disrupting current operations.

Drawing on their experience of executing similar B2B market expansions, the Commercial Programme Director led the enhancement and expansion of the new B2B Proposition to achieve significant revenue growth through product feature improvements.

Another advantage of adding a ‘fresh pair of eyes’ in scenarios like this are the opportunities that can be identified which others may have missed or overlooked. It’s common for an interim executive to be brought in to address one area of importance or concern, and through continued work with the CEO and Executive team, identify additional areas for optimisation that both complement and expand on the original assignment, delivering further value. In this instance, the commercial executive interim also led a step-change in the front-end digital customer offering as well transforming their pricing model, leading to an improvement in customer experience and higher customer satisfaction rating.

The result was a new proposition delivered on time, to budget and opening up a new customer base and revenue stream for the business.

Scenario 3: Turning a business around in decline

The final scenario where Executive Interims can add significant value is with businesses in distress. In these situations, transformation specialists add an injection of additional commercial leadership expertise at a time when leaders within the business are under significant pressure to remedy the situation. Their experience, knowledge, and objectiveness can help provide clarity to the executive team, as well as a calm head to plan and execute a business transformation.

For example, a European manufacturing business with sales and profits declining were acquired by a private equity fund who sought to return the business to grow. With the business not wanting to wait for the conclusion of a permanent recruitment process (and also concerned with who they might attract whilst in decline), they decided to engage an Interim Chief Commercial Officer to join them immediately for an eighteen-month period to undertake a commercial transformation programme.

The Executive Interim started by leading a major process improvement through integration of a new ERP system that enabled the business to drive sales and better pipeline management. The Executive Interim then developed a global digital marketing strategy to optimise customer experience and e-commerce opportunities as well as implementing a multi-site global training function to train customers and staff and transforming after-sales and online sales.

The result was a growth of 11% year on year and a significant increase in EBITDA. The Executive Interim also worked with the Executive team to help recruit a new permanent Chief Commercial Officer who would lead the business for the final stage of the deal cycle.

The Smart Money Is Understanding How To Effectively Utilise Executive Interims

As the Executive Interim market matures, more businesses are seeing that Interims bring value beyond filling a short-term gap. Our research indicates that urgent vacant leadership positions now only account for 33% of common deployment scenarios.

Private Equity firms, in particular, have been quick to recognise that Executive Interims are well suited to short-term business situations which require specific skill sets that aren’t necessarily required in that position long term. They see Executive Interims as change agents, able to draw on their significant experience to deliver what the business needs right now while giving them the space to plan for the future with the flexibility to pivot at short notice. Private Equity firms typically have absolute clarity on the desired business outcome and are willing to put their money where their mouth is and invest behind the suggested course of action. Their return on investment is typically very high.

For businesses that are clear on their objectives and have the funding in place to make change happen, Executive Interims can prove to be a valuable addition.